Where in the World Is Coal Energy Used

INFOGRAPHICS | March 26. 2020. 6:01

Mapped: The world's coal power plants

Since 2000, the world has doubled its coal-fired power capacity to around 2,045 gigawatts (GW) after explosive growth in China and India. A further 200GW is being built and 300GW is planned.

More recently, 268GW has closed due to a wave of retirements across the EU and US. Combined with a rapid slowdown in the number of new plants being built, this means the number of coal units operating around the world fell for the first time in 2018, Carbon Brief analysis suggests.

Another 213GW is already set to retire and 19 of the world's 80 coal-powered countries plan a complete phaseout of the fuel, including the UK and Germany.

Meanwhile, electricity generated from coal has plateaued since 2014, so the expanding fleet is running fewer hours. This erodes coal's bottom line , as does competition from other fuels. It would now be cheaper to build new wind and solar than to keep running half of existing coal plants.

The way coal's next chapter unfolds is key to tackling climate change. Global unabated coal use must fall by around 80% this decade if warming is to be limited to less than 1.5C above pre-industrial temperatures, according to recent Carbon Brief analysis.

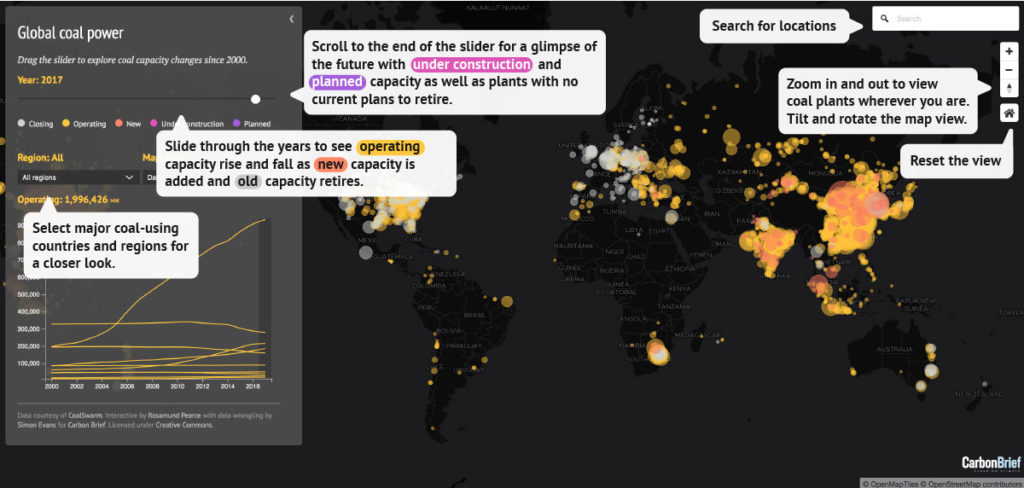

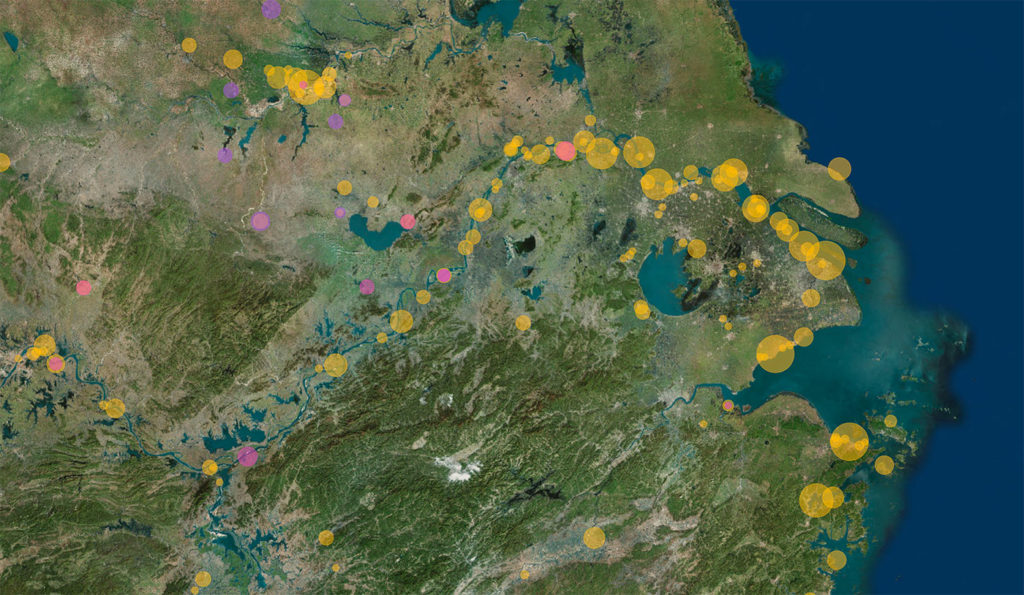

To shed light on this story, Carbon Brief has mapped the past, present and future of all the world's coal-fired power stations. The interactive timeline map, above, shows the plants operating in each year between 2000 and 2019, as well as the location of planned new capacity.

This map has been fully updated since it was originally published in 2018, using the latest data from the Global Energy Monitor (formerly CoalSwarm) Global Coal Plant Tracker . It features around 10,000 retired, operating and planned coal units, totalling around 3,000 gigawatts (GW) across 99 countries. The 2018 and 2019 versions of this article have been archived.

- How to read the timeline map

- Rising coal capacity

- Slowing coal growth

- Peak coal CO2 emissions

- Eroding coal economics

- Key countries and regions

How to read the timeline map

The timeline map above shows a circle for each coal plant in the world, proportional to the generating capacity in megawatts (MW). Each plant may be made up of multiple units – the individual boilers and steam turbines. The notes at the end of this article explain how the data was processed.

The graphic, below, explains how to use the map features. Select the year, region and base map – including a satellite view – using the information box on the left.

Zoom, rotate and tilt the map using the navigation tools in the top right corner and your mouse scroll wheel. Use the search box to find locations by city, region, postal or zip code. The home button will reset the map to its original state.

Coal plants on the map are colour-coded according to whether they are operating (yellow), new or expanded that year (red) and closing or shrinking the following year (white).

Drag the timeline slider from 2000 through to 2019 to see where and when coal plants are added and retired. For 2019, plants are coloured white if they are expected to close some or all of their units.

The rightmost end of the slider ("Future") shows plants that have no known plans to retire (yellow), those currently being built (pink) and those in various stages of planning (purple).

Note that between 2010 and 2019, only 35% of planned capacity was built or started construction (993GW), whereas 1,815GW was cancelled or shelved, according to Global Energy Monitor . For example, a tender to build one new plant may attract several bids, all of which would be counted towards the "planned" total.

The map shows coal capacity, whereas electricity generation and CO2 emissions depend on a range of other factors. Most important is how often coal plants run – their load factor. Global average loads started falling in 2007 and coal power CO2 has levelled off since 2014. More on this below.

Finally, note that the map design is responsive and has fewer features on smaller mobile devices. The map uses WebGL and will not work on some older browsers. The map may also fail to load if you are using an ad-blocking browser plugin; try whitelisting the Carbon Brief website.

Rising coal capacity

Global coal capacity grew in every year between 2000 and 2019, nearly doubling from 1,066GW to 2,045GW. As far back as 1950, coal capacity has only ever risen – though this older data is less reliable. The rate of growth is slowing dramatically, however, with the 20GW net increase in 2018 the smallest in several decades.

The promise of cheap electricity to fuel economic growth has driven this expansion. But new coal is now more expensive than renewables in all major markets around the world, according to recently released analysis from thinktank Carbon Tracker .

Coal generates nearly 40% of the world's electricity, close to its highest share in decades. And there are now 80 countries using coal power, up from 66 in 2000. Another 13 plan to join the club, notably Egypt and the United Arab Emirates, though this is down from 16 last year.

CO2 emissions from existing plants are enough to breach the carbon budget for 1.5 or 2C. UN secretary general António Guterres is leading calls for an end to new coal plant development.

All unabated coal would have to close by 2040 to stay "well below" 2C, according to the International Energy Agency (IEA). This would mean closing 100GW of coal capacity every year for 20 years, or roughly one coal unit every day until 2040. (Some pathways have slightly slower phaseouts.)

For the more ambitious 1.5C limit, global coal use for all purposes would need to fall by around 80% this decade, according to Carbon Brief analysis of pathways gathered by the Intergovernmental Panel on Climate Change (IPCC). This would be equivalent to closing every coal plant in the world.

Yet newspaper headlines and energy projections suggest coal growth will not stop.

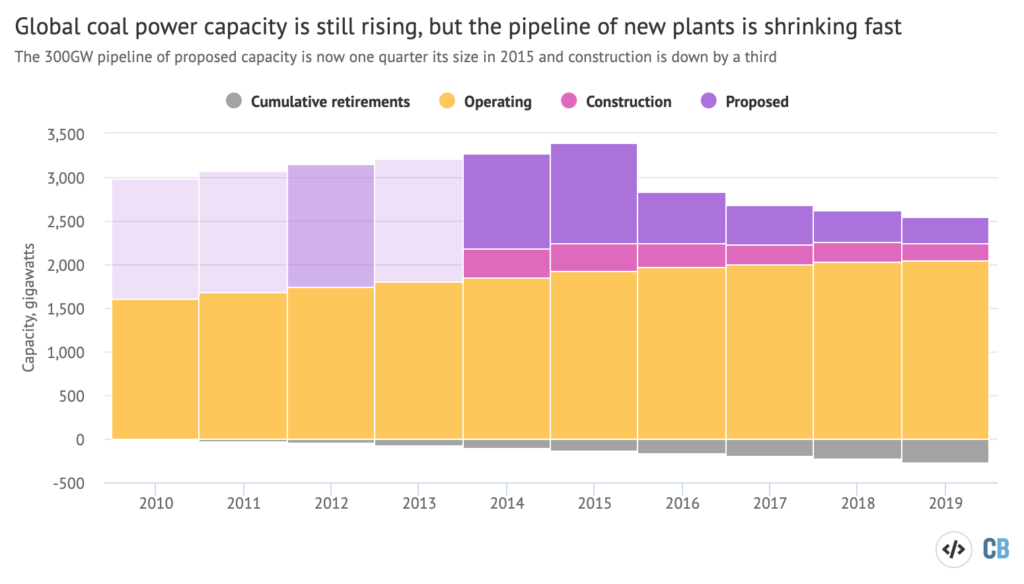

This bleak outlook for the climate is tempered by signs of rapid change. The pipeline of plants under construction (pink) or proposed (purple) has shrunk by two-thirds since 2015, as the chart below shows. Retirements (grey) are also accelerating, reaching a cumulative 268GW between 2010 and 2019.

Global coal power capacity operating in 2010 through to 2019 (yellow) as well as cumulative retirements (red) and capacity being built (purple) or planned (grey). Sources: Global Coal Plant Tracker 2014-2020; World Resources Institute Global Coal Risk Assessment 2012. Plans for 2010, 2011 and 2013 are interpolated from other years. Chart by Carbon Brief using Highcharts.

As with global CO2 emissions, however, the world's coal capacity has to peak before it can start to fall.

Slowing coal growth

The IEA says global coal investment has already peaked and is now in a "dramatic slowdown". It says that China, which is building much of the current pipeline, has no need for new plants.

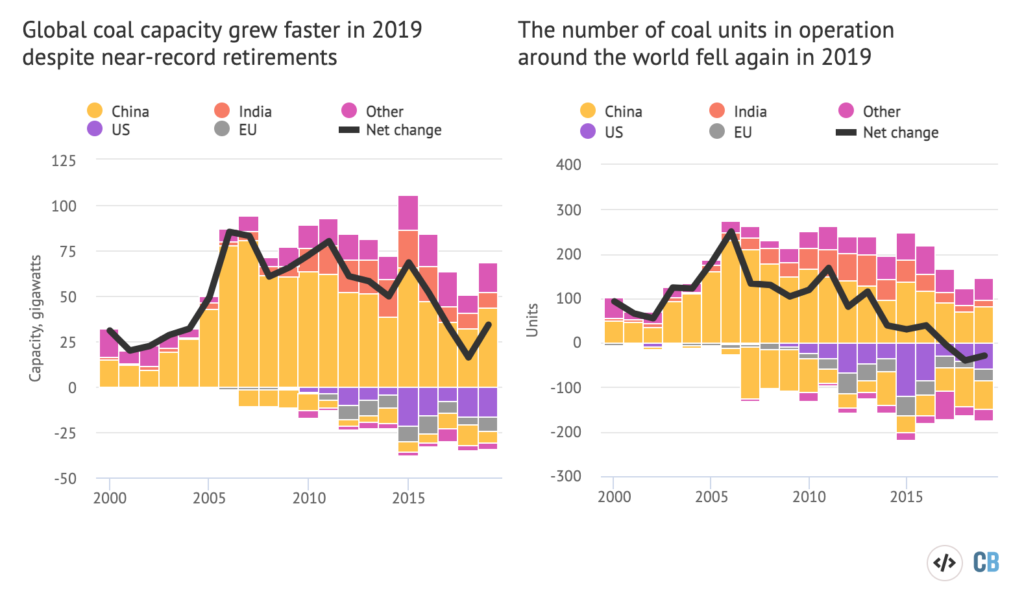

This fall in investment means coal capacity growth is slowing, as the chart below left shows. In 2011, global coal capacity increased by 82GW. This figure was 80% lower in 2018, at 16GW, though it ticked up again in 2019 to 34GW.

Left: Coal power capacity additions and retirements (gigawatts) between 2000 and 2019 (coloured columns) and the global net change (black line). Right: The number of coal units added and retired by country (coloured columns) and the global net change (black line). Source: Global Coal Plant Tracker and Carbon Brief analysis. Chart by Carbon Brief using Highcharts.

The number of plants newly under construction each year is falling even faster, down 66% in 2019 compared to 2015, according to the latest annual status report from Global Energy Monitor. Meanwhile, coal retirements are at historically unprecedented levels, with the 34GW of closures in 2019 a close third behind 2015 (37GW) and 2018 (35GW).

In its 2018 status report, GEM speculated that global coal power capacity could peak as soon as 2022. However, a new and potentially much higher cap on coal capacity in China, being debated as part of its 14th five-year plan for 2021-25, could cast doubt on this outlook, see below for more.

Intriguingly, the number of coal units in the world could already have peaked, as the chart above right shows. In 2017, the number of units fell by four, down from a net increase of 260 in 2006. In 2018, the number of units decreased by 40 and there was another reduction of 29 in 2019.

The chart shows how several countries, notably China, have been closing many hundreds of smaller, older and less efficient units, replacing them with larger and more efficient models.

Peak coal CO2 emissions

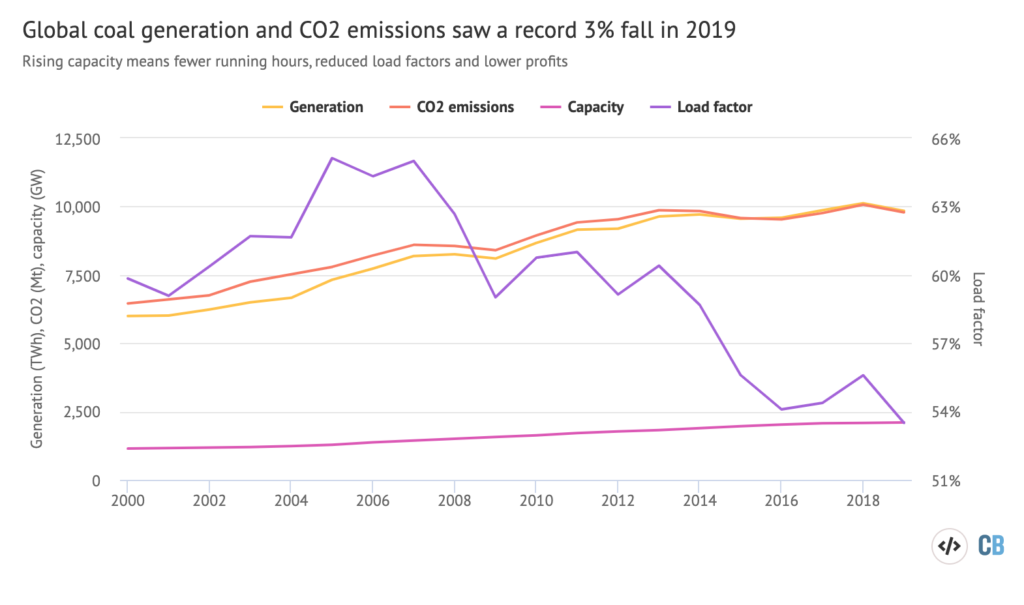

Data from the IEA and recent Carbon Brief analysis shows CO2 emissions from coal power have levelled off, even though coal capacity continues to increase. Coal CO2 emissions were flat during 2014-2019 (red line) despite coal generation rising 1.4% (yellow), as the chart below shows.

Since coal capacity continues to increase (pink), existing coal plants are running for fewer hours (purple). On average, the world's coal plants were running around half the time in 2019, with a load factor of 53.5%. The trend is similar in the US (49%), EU (37%), China (49%) and India (57%).

Left axis: Global coal-fired electricity generation (yellow, terawatt hours), CO2 emissions (red, millions of tonnes of CO2) and capacity (pink, gigawatts) between 2000 and 2019. Right axis: Average load factors for the global coal fleet (purple, %). Source: IEA World Energy Outlooks and Carbon Brief analysis. Unlike the rest of this article, the IEA data includes small coal plants of less than 30MW. Chart by Carbon Brief using Highcharts.

Apart from running hours, a range of other factors affect the relationship between coal capacity and CO2 emissions. These include the type of coal and combustion technology each plant uses.

Plants burning low-quality lignite can emit as much as 1,200 tonnes of CO2 per gigawatt hour (GWh) of electricity generated, falling below 1,000tCO2/GWh for harder, less polluting grades from sub-bituminous through to bituminous coal. (Rarely used anthracite is hard, but has high CO2 emissions, as it contains less hydrogen than other grades.)

The combustion technology is also important, from less efficient "subcritical" units through to super- and ultra-supercritical systems, which raise efficiency by running the boiler at higher pressures.

The oldest and least efficient subcritical units might turn less than 35% of the energy in coal into electricity. Newer subcritical plants raise this towards 40% and ultra-supercritical units to 45%.

Parts of the coal industry refer to ultra-supercritical units as "high efficiency low emissions" (HELE).

However, even HELE coal plants emit around 800tCO2/GWh, according to the World Coal Association. This is roughly twice the emissions of gas-fired electricity and in the order of 50-100 higher than nuclear, wind or solar. The IEA sees little role for coal-fired power in 2C scenarios as residual emissions are too high, even when using carbon capture and storage (CCS).

Note that the chart, above, contains the latest available information from the IEA supplemented with more recently Carbon Brief published analysis. This found a record 3% decline in coal generation in 2019, driven by dramatic reductions in Europe and the US, as well as a fall in India. See below for more on coal's status in key countries.

Eroding coal economics

Low load factors are corrosive for coal-plant economics. In general, plants are designed to run at least 80% of the time because they have relatively high fixed costs. This is also the basis of cost estimates for building new coal, whereas lower running hours raise costs per unit of electricity.

This dynamic is particularly toxic for coal-plant operators competing against the rapidly falling costs of renewables, cheap gas in the US and rising carbon prices in the EU. Constraints on coal supply are raising coal prices, further undermining any remaining cost advantage over the alternatives.

New air pollution rules are also increasing coal-plant costs in many jurisdictions, from the EU to India to Indonesia. Operators must invest in pollution control equipment to meet higher emissions standards, or close their dirtiest plants altogether.

This combination of factors means that large parts of the existing coal fleet in the EU and even China or India face severe economic headwinds, recently highlighted by financial thinktank Carbon Tracker .

In a report published in March 2020 it found that more than 60% of the world's coal plants are generating more expensive electricity today than could be supplied by building new wind or solar plants. It says this figure will rise to 100% of plants in the world's major markets by 2030.

This marks the second of two " tipping points " for coal, predicted by Bloomberg New Energy Finance founder Michael Liebreich in 2017.

The first tipping has been passed in most regions, where new renewable energy is now already cheaper than new coal . The second tipping point was for new renewables to be cheaper than existing coal, as shown in the Carbon Tracker analysis for the majority of the world's plants.

Note that coal plants may remain open in the face of unfavourable economic conditions for other reasons, for example, due to capacity market payments.

Key countries and regions

Some 80 countries use coal to generate electricity, up from 66 in 2000. Since then, 15 countries have added coal capacity for the first time and one country – Belgium – has phased it out.

Another 19 countries – responsible for 5% of current capacity – have pledged to phase out coal as part of the "Powering Past Coal Alliance", led by the UK and Canada. This now officially includes Germany, home to the world's fifth-largest coal fleet and some 2% of the global total. Meanwhile, 13 countries hope to join the coal power club in future, including Egypt, shown in the table, below.

A few key countries dominate this picture. The world's top 10 nations for coal capacity, shown in the table below left, account for 86% of the total operating today. The top 10 for capacity planned or under construction is a slightly different list but it, too, accounts for 86% of the total pipeline.

| Country | Operating (MW) | Share | Country | Pipeline (MW) | Share |

|---|---|---|---|---|---|

| China | 1,004,948 | 49.1% | China | 205,886 | 41.2% |

| United States | 246,187 | 12.0% | India | 66,025 | 13.2% |

| India | 228,964 | 11.2% | Turkey | 33,180 | 6.6% |

| Russia | 46,862 | 2.3% | Indonesia | 31,200 | 6.3% |

| Japan | 46,682 | 2.3% | Vietnam | 30,942 | 6.2% |

| Germany | 44,470 | 2.2% | Bangladesh | 22,984 | 4.6% |

| South Africa | 41,435 | 2.0% | Japan | 11,881 | 2.4% |

| South Korea | 37,600 | 1.8% | South Africa | 11,050 | 2.2% |

| Indonesia | 32,373 | 1.6% | Philippines | 10,536 | 2.1% |

| Poland | 30,870 | 1.5% | South Korea | 7,260 | 1.5% |

China has the largest coal fleet by far and is also home to the world's heaviest concentration of coal plants, with around 100GW in a 250km radius along the Yangtze River delta around Shanghai. This is more capacity than all except three countries (China, India and the US), as the table above shows.

China

Since 2000, the most dramatic changes have taken place in China, as the slider below shows. Its coal fleet grew five-fold between 2000 and 2019 to reach 1,005GW, nearly half the global total.

China is the world's largest CO2 emitter and uses half the coal consumed each year, so its future path is disproportionately important for global efforts to tackle climate change.

Industrial activity and coal use were spurred by stimulus spending prior to President Xi's appointment as " leader for life " in 2018. In 2019, overall electricity demand growth slowed and the increase was mostly met by low-carbon sources, meaning coal use flattened .

In the first few months of 2020, the coronavirus pandemic and subsequent lockdowns across China saw coal generation plummet to multi-year lows. Looking to the longer term, the main question will be the nature of the expected government stimulus in response to the crisis.

Meanwhile, a heated debate is taking place over whether to allow hundreds of new coal plants to be built under China's 14th five-year plan for 2021-2025. Powerful interests from the power sector are pushing for higher coal targets, which would be at odds with China's climate goals.

On the other hand, the sector is under pressure from renewables, a power price freeze and upcoming electricity market reforms, as well as a national carbon trading scheme . Typical power plants in China now run at less than half of their rated capacity, further weakening profits.

Last year saw the first bankruptcies in the sector and China's state-owned asset supervisor, which has proposed a radical reorganisation of the industry, might be expected to oppose further growth.

Overall, China's pipeline of plants being built or planned has shrunk more than 70% since the end of 2015, according to Global Energy Monitor . Its data shows that some 134GW of planned capacity was cancelled in 2019 alone, though some previously on-hold schemes were also revived.

India

The second-largest increase in capacity since 2000 has been in India (see Carbon Brief's new in-depth country profile), where the coal fleet has more than tripled to 229GW. This expansion can be seen in the slider, below.

Indian coal capacity will continue to rise, reaching 238GW in 2027, according to the government's National Electricity Plan . Other analysts and indicators suggest this increase may be in doubt .

The rate of coal capacity growth in India has more than halved since 2016, as the chart above shows, and there are signs it is slowing ever further. In 2019, coal-fired electricity output fell in India for the first time in at least three decades.

The IEA has dramatically cut its forecasts for Indian demand, due to slower than expected electricity demand growth and the falling price for renewables .

"From an economic perspective, it would make sense to substitute new renewables for existing coal," according to a 2019 report from The Energy and Resources Institute in New Delhi.

In a February 2019 comment, Reuters commodities columnist Clyde Russell wrote : "The main reason coal may battle to fuel India's future energy needs is that it's simply becoming too expensive relative to renewable alternatives, such as wind & solar." Similarly, consultants Wood Mackenzie suggests solar is 14% cheaper than coal in the country.

Indeed, some 10GW of existing coal was already "unviable" and another 30GW "stressed", according to India's power secretary, interviewed by Bloomberg Quint in May 2018. (The economic status of most of these plants has been or is now in the process of being resolved.)

Meanwhile, prime minister Narendra Modi has announced even more ambitious targets for renewable expansion. If they are met, they would further limit the case for new coal capacity.

In 2019 alone, some 47GW of planned coal capacity was cancelled in India, according to Global Energy Monitor. The country now has just 66GW of new coal capacity under development, down 30% in each of the past two years alone – and 80% since a figure of 311GW in 2015.

The current pipeline includes 37GW under construction, half of which is on hold , most often due to financial problems, according to Global Energy Monitor.

US

A wave of retirements has cut US coal capacity by 105GW since 2010 and another 71GW is already planning to close, according to Global Energy Monitor. This would shrink the US fleet by half, from 327GW in 2000 to 175GW in future, as the slider below shows.

One wildcard is the Trump administration's continued wish to prop up unprofitable coal plants. In 2018 it had planned what Bloomberg called "an unprecedented intervention into US energy markets" on national security grounds. It also abandoned efforts in the name of "grid resilience".

Market conditions, on the other hand, continue to favour gas-fired power plants and renewables. There are no plans for new US coal capacity. Retirements in 2019 reached 16GW, second only to 2015, and closures have averaged 14GW a year during Trump's tenure to date.

In 2019, US coal generation fell by a record 18% to the lowest level since 1975, marking the end of a decade in which electricity output from the fuel was cut in half.

Some 74% of US coal plants have higher operating costs than the price of building new renewables nearby, according to March 2019 analysis from Energy Innovation , a thinktank.

See Carbon Brief's earlier map of all the power plants in the US for more.

EU

The EU and UK are also seeing a wave of coal retirements. Given plans to phase out coal, the region's fleet is set to fall below 50GW, to a quarter of its capacity in 2000, as the slider below shows.

Along with Canada, European countries are leading global efforts to phase out coal. The UK, France, Italy, Netherlands, Portugal, Austria, Ireland, Denmark, Sweden, Finland, Hungary, Slovakia and Greece have all pledged a phaseout before 2030. This includes several recently built plants .

Now, the world's fifth largest national coal fleet – Germany's 44GW – is set to be phased out, too, albeit by 2038 at the latest . After that, Poland's 31GW is the world's tenth largest tally.

Poland has said it would not build new coal beyond what was already under construction. One of these schemes, Ostroleka C, could now be switched from coal to gas.

Some 66GW of coal has closed in the EU and UK since 2010, including 8GW in 2019 alone. Research in 2017 suggested all EU coal plants should close by 2030 , in order to meet the goals of

Other key countries

Other Asian countries, including South Korea , Japan , Vietnam, Indonesia, Bangladesh, Pakistan and the Philippines, have collectively doubled their coal fleet since 2000, reaching 202GW in 2019.

Together, these countries are building 47GW of new plants and have another 87GW planned, though the latter figure is some 38GW lower than it was two years ago. Many of the projects in poorer nations are being financed or built by China , Japan and South Korea .

Campaigners see a fast-developing Asia as the key risk for coal expansion . Lauri Myllyvirta, lead analyst at the Centre for Research on Energy and Clean Air tells Carbon Brief:

"China and India still matter a lot, but, megawatt for megawatt, I would put a lot more weight on other parts of Asia."

There are mixed signs for coal in many of these countries. For example, Japan's latest national energy plan sees a significant role for coal in 2030, whereas the Paris Agreement means it should mostly phase out coal by then, according to Climate Analytics, a scientific NGO.

Japan's recently updated Paris climate pledge makes no mention of the fuel and some 9GW of capacity remains under construction. However, the country's environment ministry is reported to have said in March 2019 that it would not, in principle, sanction large new coal plants. Environment minister Shinjiro Koizumi said in February 2020 that rules on coal plant exports would be reviewed.

Major plans for new coal capacity are opposed by communities, NGOs and some newspapers . More than a third of the new plants planned at the start of 2016 have been cancelled or shelved.

Vietnam has the world's fifth-largest plans for new coal, totalling 31GW, of which 9GW is already being built. "Yet the government is increasingly invested in changing this trajectory," writes Alex Perera , deputy director of energy at thinktank the World Resources Institute . He continues:

"Vietnam provides an interesting and important combination of conditions that can enable a meaningful transition to clean energy: government commitments to renewables and a private sector eager to meet increasingly stringent clean energy targets."

Ambitious plans to expand gas power in Vietnam may replace some coal plants, Bloomberg reported in March 2019. The country now has more utility-scale solar capacity than Australia.

In Indonesia, the government continues to plan for a major coal expansion. Earlier in 2020, however, Reuters reported that the country planned to replace some 11GW of old coal and gas plants with renewables. The state-owned utility has been criticised for "massively overestimating likely [electricity] demand growth" to justify new coal. (See Carbon Brief's in-depth country profile of Indonesia for more details.)

Turkey also has significant plans to expand its coal fleet (see Carbon Brief profile of Turkey's climate and energy policy). Notably, however, less than 2GW of a total pipeline of 33GW of new coal is currently under construction – and that pipeline has shrunk by 10GW in two years.

Another country with major plans is Egypt, which has no coal plants and no domestic coal deposits. Note that none of the 13GW of planned capacity has moved beyond the earliest phases of development, with none entering the permitting process, none yet permitted and none being built.

South Africa has large coal deposits and the world's seventh-largest coal power fleet. It is building 5GW of new coal with plans for 6GW more. The political mood has shifted somewhat since Cyril Ramaphosa's election , however, and long-delayed renewable deals worth $4.7bn were signed in 2018.

Unusually, South African heavy industry favours renewables over continued coal growth. New coal would be much more expensive than the alternatives, separate research suggests. In March 2019, state power firm Eskom said it was looking at leaving two huge coal plants unfinished.

Methodology

Carbon Brief's timeline map is based on the Global Coal Plant Tracker, compiled by Global Energy Monitor. The current map uses data from January 2020. This database includes all coal units of 30MW capacity or larger, covering operating and retired plants as well as those proposed since 2010. (As noted above, there are thought to be roughly 27GW of smaller coal plants.)

This covers a total of 2,045GW of capacity operating today, 200GW under construction, 300GW in planning, 315GW retired and 1,522GW that has been proposed, but then cancelled since 2010.

Carbon Brief made a number of assumptions to compile the map, explained below.

As of March 2019, 27 countries have joined the Powering Past Coal Alliance on phasing out coal power, of which 13 still have operating plants. Each of these countries is assumed to complete its phaseout by the pledged year. Germany is assumed to meet a 2038 phaseout deadline.

Coal units – the individual boilers listed in the database – are grouped together using the listed "Plant" name. However, some sites have two or more plants with subtly different names, such as "Plant-1", "Plant-2". These plants are grouped again in a second automated step based on their latitude. In these cases, only the first name (Plant-1) is retained for the map.

Some grouped plants have units using different combustion technologies, such as subcritical and supercritical boilers. During the data grouping step, some of these differences will have been lost. For grouped plants, the map shows the range years when units started operating.

Plants in the pipeline are a mixture of sites under construction, already permitted, pre-permit and at an early stage of planning ("announced"). Some sites host projects at different stages of this process, which would be semi-hidden on the map since their locations are the same. A random offset on the order of ±50m is applied to the location of all units in the pipeline, so as to artificially separate them on the map.

The map omits 13 units in the database lacking information on capacity, as well as 98 operating or retired units, totalling 4.6GW, that lack location data. There is 12GW of capacity marked as "mothballed", meaning it is in a state of temporary disuse. These are included with "operating" capacity as there is no information on the timing or length of the mothballing.

There are 144 retired units (8.6GW) and 151 operating units (9.5GW) without a listed "Start Year". The map assumes these units have been operating since 2000 onwards. Six units (0.3GW) are listed with a "Start Year" of 1960s, 1970s or similar. These are assigned to 1965, 1975 and so on.

Some 97 retired units (5.6GW) lack a "Retire Year", most of which are in China. These plants are assigned a random retirement year between 2000 and 2018, using years weighted according to the distribution of known retirements in China and the rest of the world, respectively.

Where in the World Is Coal Energy Used

Source: https://www.carbonbrief.org/mapped-worlds-coal-power-plants